how much is a million dollar life insurance policy for a 60 year old

In 2019 96 million of the 114 million people enrolled in health insurance through the ACA marketplace received subsidies that lower premiums and out-of-pocket costs at an estimated cost of about 56. In the previous example prices went from approximately 12500 to 6500.

2022 Final Expense Insurance Guide Costs For Seniors

For example the average life insurance quote only increases by 6 between ages 25 and 30 but it jumps much higher between ages 60 and 65 an average increase of 86 or 275 per month.

. The dollar amount that. That is a 48 decrease in price. As you can see blending a whole life policy with term insurance can reduce costs significantly.

If you are 65 years old and need life insurance affordable policies are still possible. A 20-year term life insurance policy costs an average of more than 147 a month. A 10-year term 100000 life insurance policy for a male will cost about 56 a month.

Census Bureau reported that 285 million people 88 did not have health insurance in 2017 down from 499 million 163 in 2010. NAILTA represents the interests of those independent settlement service providers who serve over 31 million real estate purchase consumers per year who close an estimated 5148 billions worth of refinance mortgages per year and who collectively insure approximately 167 trillion in total national title insurance liability per year. For the same policy for a female it will cost about 36 a month.

Term life insurance rates by policy size. Here is an illustration example of a blended whole life policy. 32 33 Between 2004 and 2013 a trend of high rates of underinsurance and wage stagnation contributed to a health-care consumption decline for low-income Americans.

In fiscal year 2019 the federal government spent 44 trillion amounting to 21 percent of the nations gross domestic product GDP. So for example if you make 50000 dollars per year you should get a policy in the amount of 250000 to 500000. How Much Life Insurance Should I Get.

But if you can only afford around 100K get your cheap rates below. Working with an independent agent is the best way to secure the lowest rates. A often used rule of thumb is that you should get 5 to 10 times the amount of your annual salary in life insurance.

Pin On Colonial Penn Life Insurance 9 95

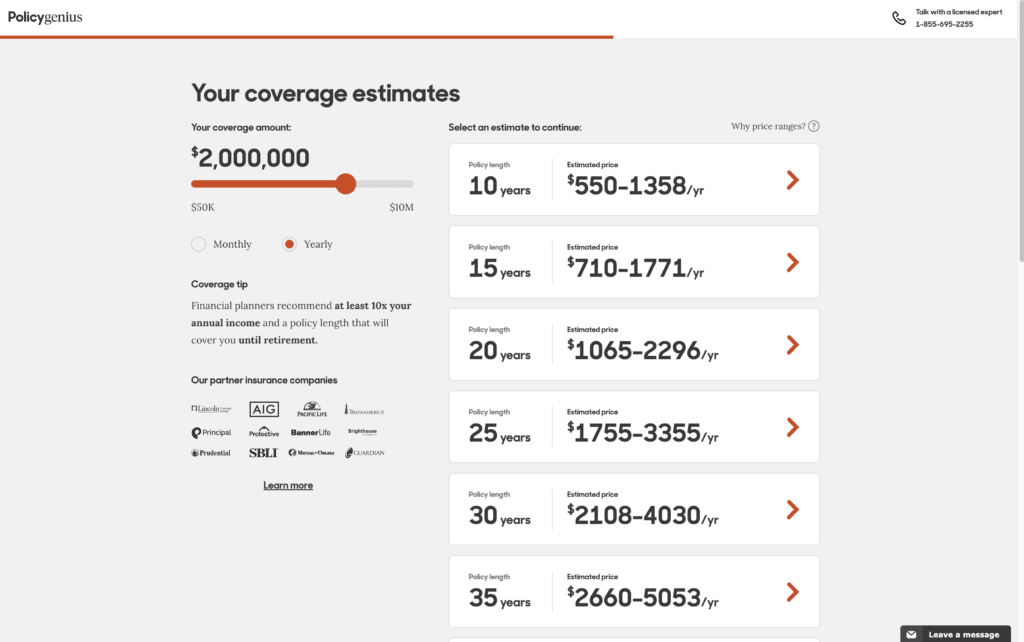

2 Million Dollar Life Insurance Is It Worth It

Compare Life Insurance Rates By Age 2022 Rate Charts

How Much Is Life Insurance In Canada Average Costs Policyme

Paid Up Additions Work Magic In A Bank On Yourself Plan

Whole Life Insurance Rates By Age With Charts Customizable Designs To Meet Your Needs And Goals

Term Life Vs Whole Life Insurance Understanding The Difference

1 Million Dollar Life Insurance Is It Right For You

Aarp Term Life Insurance Rates By Age Chart 2022 Policymutual Com

Whole Life Insurance Quotes June 2022 Policygenius

How Much Is A Half Million Dollar Life Insurance Policy 500 000

Life Insurance Over 70 How To Find The Right Coverage

Colonial Penn No Exam Life Insurance Review Valuepenguin

Best Life Insurance For Seniors Over 60 Valuepenguin

How Much Does A Million Dollar Life Insurance Policy Cost Forbes Advisor

5 Tips For Selling Your Life Insurance Bankrate

/best-whole-life-insurance-4845955_final-c60b6733837046e5a5213deb9e87ccd5.png)